| Name | Detail | Authority | Supportive Documents |

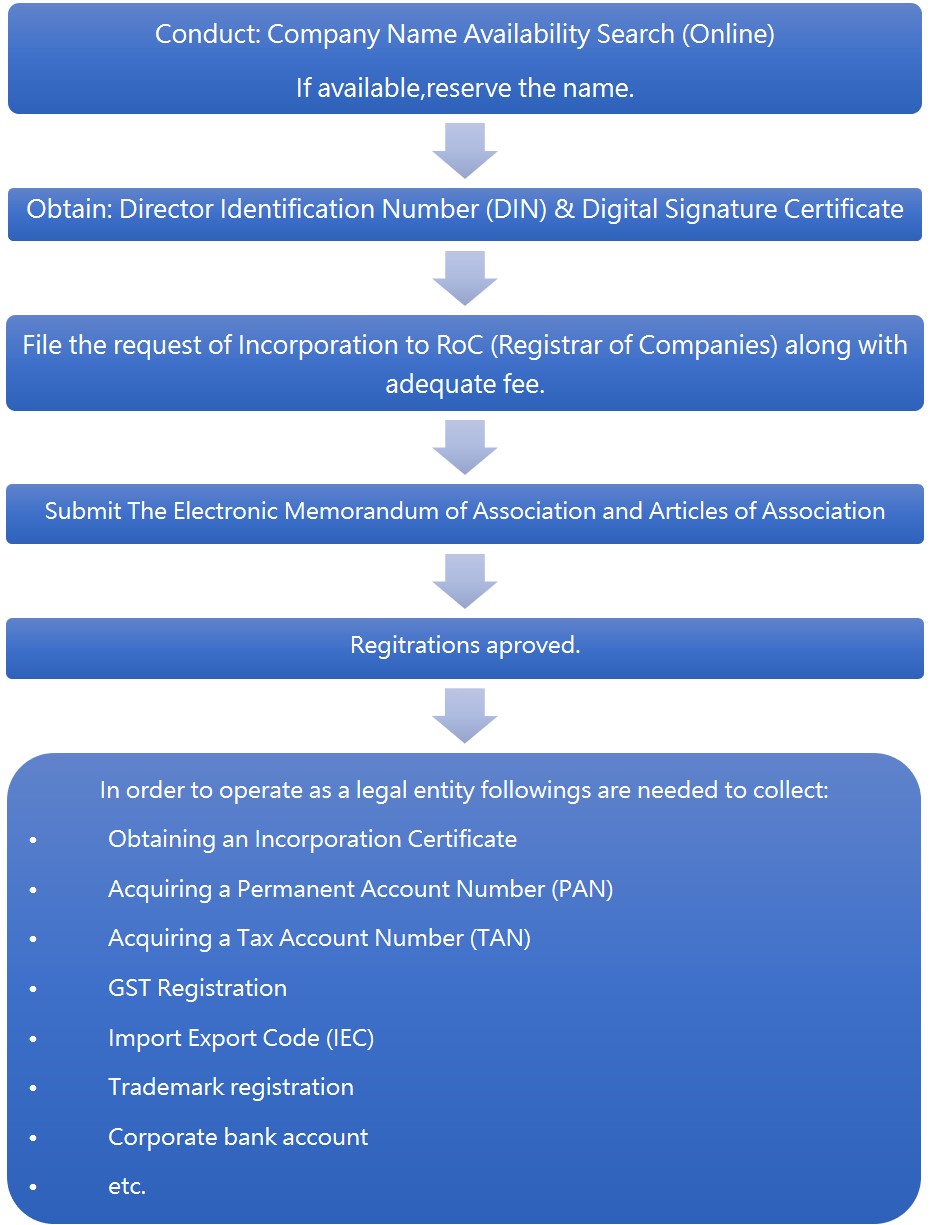

| DIN | Direct (unique) Identification Number allotted for the director of a company. | Central Government |

|

| Digital Signature Certificate (DSC) | Digital Signature Certificate | A licensed Certifying Authority | No other specific requirement |

| PAN | A PAN is a Permanent identifier issued under the Indian Income Tax Act, 1961 | Indian Income Tax Department | Company:

Natural person:

|

| TAN | Tax Account Number is to be obtained by all persons who are responsible for deducting tax at source (TDS) or who are required to collect tax at source (TCS).

|

Income-tax Department. | No other specific requirement |

| Goods and Services Tax (GST)

|

GST combines different types of State and Central level taxes. Any foreign person or foreign entity providing goods or services to India would require to have a GST registration |

|

|

| Import Exporter Code(IEC) | IEC is mandatory for export from India or Import to India. You can consider it as the main business identification number. | IEC | |

| Trademark | Trademark including logo of the company is better to register to stop the unfair competition | Indian intellectual property office |

|

| Balance Sheet and Annual Return must be filed every year. | |||

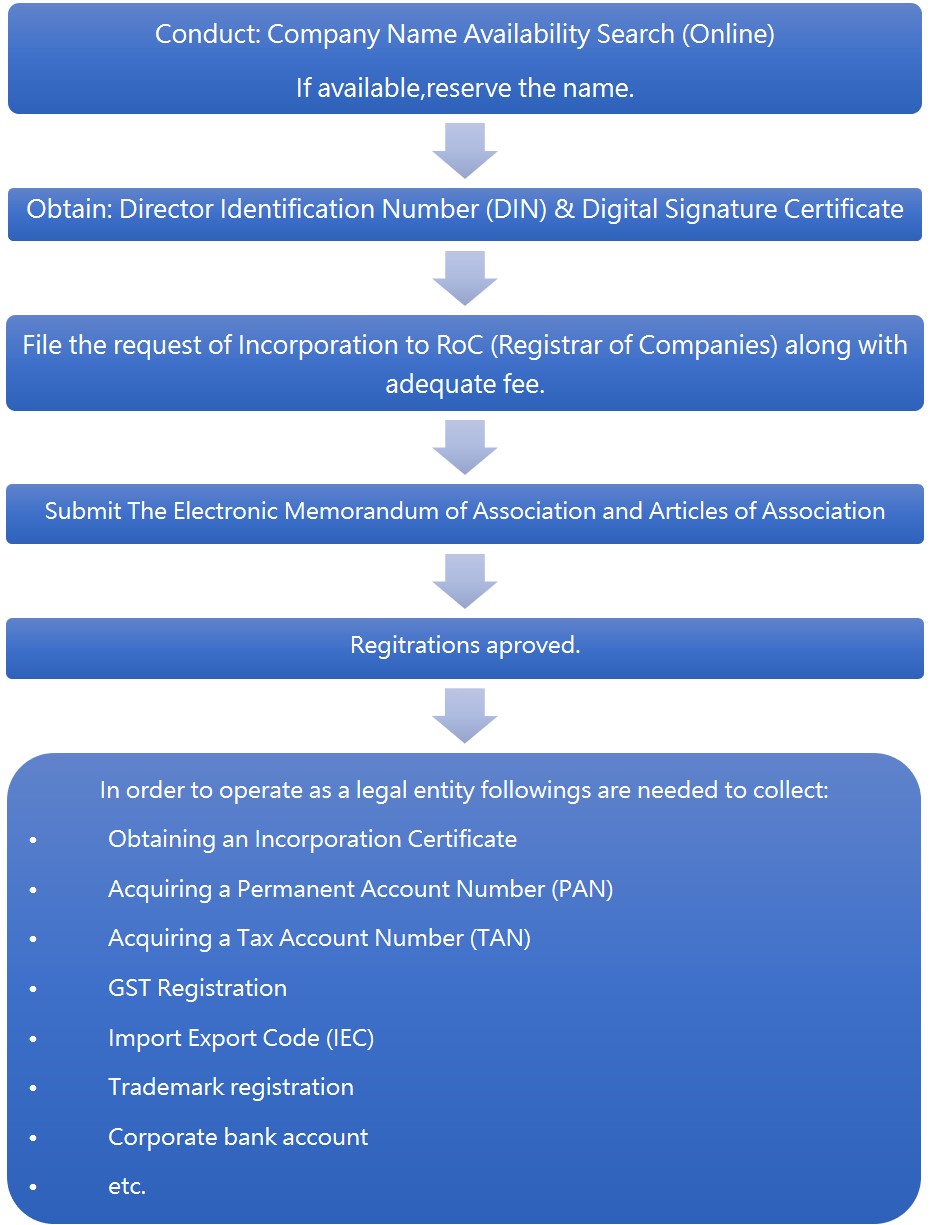

To proceed with the registration all supporting documents including photograph of the applicant required to be attested by:

|

|||